Ex-UBS Banker creates world’s first Blockchain-backed, safe and scalable AI-Driven Asset Class on Waves Platform

Interview of Dr. Lanz Chan, founder and CEO of Finamatrix Group and former banker with UBS and JP Morgan.

This document is used for informational uses only and does not constitute investment advice.

What technology solutions do you provide?

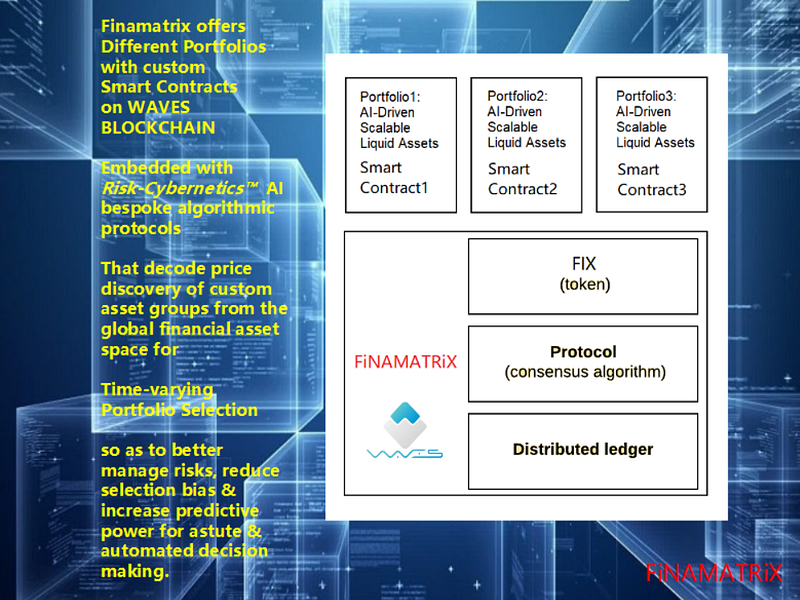

Finamatrix provides a new AI-driven asset class which is integrated with Blockchain technology so as to make transactions safe and secure due to full automation functionality that is now made possible. Our machine-learning AI is built upon proprietary technology as well as from the financial intelligence community, applied specifically to financial markets. What we believe is a game changer is our AI-Aggregator engine which involves expert experimentation merged with self-learning protocols.

When was the company founded?

The Finamatrix Group was founded in 2006 and the Singapore company was founded in early 2015.

Why was the company founded?

I founded Finamatrix in 2006 to offer financial technology (FinTech) services to a few clients.

Organization’s purpose: What we do, How do we do it, Whom do we do it for, What value are we bringing?

On a daily basis, our core technology team enhances our self-learning algorithms by training our systems to keep learning.

We do it by improving machine-learning processes which involves innovative ideas to solve mathematical problems. For example, the US dollar index increases in value by 10% which hypothetically is due to the Euro depreciating by about 5% but Euro only decreased by 2% which means that either the Euro should depreciate further or the US dollar overreacted within a certain timeframe. So shorting the Euro and US dollar index could potentially offer a very high probability trade pair for profit.

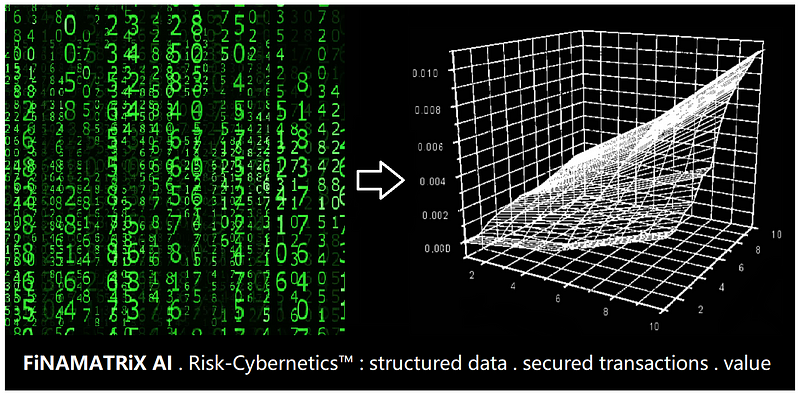

How do we perform pattern recognition? For biometric technology, if I scan your face, I will have all relevant data points for future recognition. For a price trend, we can transform the price data into a 3 dimensional surface, and like a face scan, it becomes easier to determine the patterns.

Only computers can calculate these thousands of statistics for automatic execution to capture these inefficiencies. Some details of how we determine these mispricings can be found in our technical documentation but our core technology is proprietary.

We do it mainly for our own needs in seeking a more efficient investment solution and offer it to both institutions and individuals.

The real value is in a truly autonomous asset class driven by testable AI strategies that are able to capture mispricing opportunities automatically for potential profit and at low and acceptable risk levels. These activities are impossible for a human to execute on his own.

Scope of Operations: what kind of product or service do your provide?

Finamatrix provides a convenient and safe vehicle for access to our AI-driven portfolios and a bonus program. We also offer a Cayman regulated quant fund mainly for institutional clients.

What is your future vision?

My vision is for Finamatrix to be a household brand in AI for financial markets, empowering anyone with easy access to AI.

History of the project?

Since 2006, we have constantly improved our AI technology and in 2017 we integrated it with Blockchain.

Motivation to develop the project?

The key motivation is that by integrating our AI with Blockchain, full automation in transfer, accounting, auditing, allocation, selection, optimization and other functions in a trusted and transparent environment are made possible, therefore reducing all forms of transaction costs.

What makes your project unique and valuable?

Both CEO and CTO of Finamatrix are researchers and continuously create new AI technologies with the AI-Aggregator engine. These AI strategies are completely testable and provable. We will relentlessly build the global brand value of Finamatrix by producing real value. We are also creating an app to empower people with AI for a selected asset portfolio.

What is your token?

The Finamatrix token (Symbol is FIX).

What is the token supply?

One billion tokens that is fixed. We will issue 500m tokens to the public. Each token equals one voting right. We will allow voters to vote on issues pertaining to token supply.

What is the code base that your product is using?

We are using Waves Blockchain and wallet that is KYC compliant and secure. Waves recently teamed with Deloitte to develop an orderly and regulated platform for the crypto market.

What features does your program use?

Owners of FIX tokens gain access to our AI driven asset portfolios and participate in the bonus program every financial quarter of the firm. FIX owners are able to sell tokens in exchanges or fully refund their tokens (only at ICO from Finamatrix) at cost price for bitcoins on a financial quarterly basis subject to application and verification.

Who are your competitors and how are you superior to them?

We do not consider other AI firms as competitors since we believe in collaboration and mass adoption. We believe that we have to empower anyone with AI. For example, we use Google AI in some of our testing procedures and also invest in Google stock. Finamatrix has a deep understanding of financial markets and this is critical to our success with AI.

Is there any mining or staking involved with your coins?

No. The FIX token is using the Waves Blockchain and hence the transactions are validated on the existing secure platform.

What are the future plans for your project?

We are creating an app to show how Finamatrix AI will continuously self-enhance to scour the world for mispriced opportunities autonomously. We also have an unsurpassed succession plan for business continuity. If our key men are out of action, there is a management protocol in place for Finamatrix AI to continue its business. This involves secure cloud hosting and an automatic training protocol where at least two key members of the team will be given full disclosure on operational procedures. We are building a legacy.

What other services will be offered by your project or company in the future?

We may consider offering customized AI services according to customer requirements.

What can we expect from the project in the next 6–12 months?

The integration of Finamatrix AI with the Waves Blockchain creates seamless and secure transactions. After the completion of the token sales, we will provide quarterly valuation reports of Finamatrix and customers can compare our audited valuations with previous quarters to determine the value of our firm. Our valuations include our total cash and assets with intellectual property and real estate values.

What is your expected company profitability in 2018?

We expect a gross return of more than 50% in 2018.

Expenses and current cost of operations?

Our expenses and cost of operations are low. We work in decentralized offices which are self-owned. Most of our team members are equity partners.

What will you use your investment capital for?

More than 70% will be used for capturing AI-driven profit opportunities. Less than 30% will be for research and infrastructure including real estate investment for our new office.

Does your token pass the Howey test?

The ownership of FIX token offers no promise of future income and is not a security.

Growth strategy after the ICO.

The team will further engage with our target audience and to improve our systems and infrastructure.

How many tokens do the founders get?

The founders receive 30% of the tokens.

What exchanges will this token be traded on?

FIX token can be traded on Waves decentralized exchange and on other exchanges based on customer requests.

How will you grow your market?

We have strategic partners in different regions that are able to lead with tailored online marketing and face-to-face educational events.

What is the target demographic?

Anyone keen on diversifying his portfolio with a new AI-driven asset class for potential growth.

Do you have any active partnerships?

Yes. We have partnered with a few institutions and will release more information in a press release.

What are the nature of these relationships and how are you utilizing or leveraging these partnerships?

We have marketing, venture capital and other partners that specialize in what they do and we work in concert to create sustainability for the business.

What is the vision for the company in the next 3–5 year plan?

Our vision is to further strengthen our presence in the AI industry for financial markets and to make Finamatrix a household brand.

Please provide information about the backgrounds of your CEO, CTO and other team members.

Please visit https://medium.com/@finamatrix/finamatrix-ai-team-profiles-c5424a697e8d

Technical Documentation: https://medium.com/@finamatrix/finamatrix-ai-aggregator-architecture-bd2ad9f68ea7

Whitepaper: www.finamatrix.com / www.finamatrix.net

Github: https://github.com/finamatrix

Company Social Media Links

https://www.facebook.com/groups/lucrativeluxury/

Community Channels

Company Email

info@finamatrix.com

Comments

Post a Comment